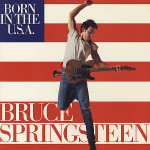

“I have spent my life judging the distance between American reality and the American dream,” said Bruce Springsteen. So, financially speaking, what do most people judge the American dream to be? Hint: It apparently sure as heck isn’t, as it was for other generations, home ownership. An interesting Scott Gamm piece on mainstreet.com reports on a Credit.com survey in which “36% of respondents said retiring ‘financially secure’ at age 65 fits their definition of the American Dream, while 25% cited becoming debt-free as their characterization.” Other excerpts from the article:

“I have spent my life judging the distance between American reality and the American dream,” said Bruce Springsteen. So, financially speaking, what do most people judge the American dream to be? Hint: It apparently sure as heck isn’t, as it was for other generations, home ownership. An interesting Scott Gamm piece on mainstreet.com reports on a Credit.com survey in which “36% of respondents said retiring ‘financially secure’ at age 65 fits their definition of the American Dream, while 25% cited becoming debt-free as their characterization.” Other excerpts from the article:

“A paltry 17% of respondents linked home ownership to the American Dream.

“While people seemed optimistic that they would be able to achieve their American Dream, with 50% saying it’s within reach, they weren’t too upbeat about other people being able to achieve the same dream. 68% said the dream was not attainable for others, compared to 55% during the same study last year.

“other research suggests plenty of Americans aren’t prepared for sudden expenses, with one-quarter of consumers having no money in an emergency savings account.

“Still, owing debt makes it more difficult to maintain a robust savings balance ready to tackle life’s unknowns. Echoing the aforementioned results of the survey, debt priorities were of utmost concern to consumers. 19% of respondents said paying off credit card debt was their most important goal for the next year, while 18% said “being debt-free” was their biggest priority.

“The study also polled millennials, ages between 18 and 29. 19% of millennials viewed being debt-free as synonymous with the American Dream, while 20% said retiring financially secure at age 65 was the American Dream.

“Millennials were largely optimistic about their prospects for achieving the American Dream, with 57% saying it’s within reach.

“For those over age 30, when asked if millennials would be able to achieve the American Dream, 40% said no.”